UBA Sierra Leone (UBA SL) has recorded one of its strongest financial performances to date, closing the 2024 financial year with a 71% increase in profit before tax and double digit growth across all key financial metrics.

This milestone was made possible through the leadership of Mohamed Alhajie Samoura, Managing Director and CEO of UBA Sierra Leone as well as the hard work of the staff within the organization.

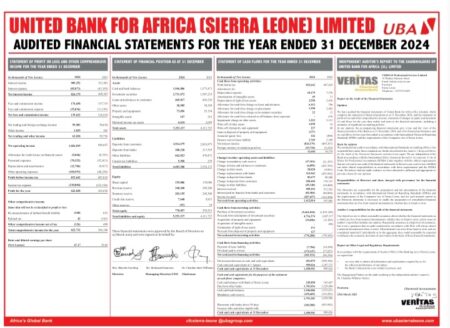

The bank’s Annual Report and Audited Financial Statements, approved by its Board of Directors and the Bank of Sierra Leone, reveals a surge in the bank’s profit before tax of NLe 833.6 million up from 487.8 million in 2023. Profit after tax rose to NLe 622.8 million, compared to NLe 365.6 million the previous year. Gross earnings climbed 59% to NLe 1.1 billion, driven by solid growth in both interest and non-interest income.

The report underscores a year of robust performance, operational efficiency, and strategic expansion for UBA Sierra Leone.

UBA Sierra Leone’s 2024 Annual Report

Outstanding Financial Performance of UBA Sierra Leone

The impressive results reflect UBA Sierra Leone’s expanding footprint in the financial sector, bolstered by its diverse service portfolio. Key growth drivers included transactional banking, innovative digital platforms, trade finance solutions, and a strong performance in foreign exchange operations.

Despite a 22.4% increase in operating expenses largely due to inflation and increased business volume, UBA Sierra Leone significantly improved its cost-to-income ratio, dropping from 23.6% to an efficient 18.1%. This demonstrates the bank’s continued commitment to operational excellence and cost discipline.

“The Board is pleased with the Bank’s outstanding achievements in 2024. The achievement of the Bank reflects the dedication and support of my colleagues on the Board, the Management, and Staff of the Bank, who deserve the highest commendation,” shared Dr. Claudius Bart Williams, the Board Chairman of UBA Sierra Leone.

Dr. Claudius Bart Williams, the Board Chairman of UBA Sierra Leone

UBA Sierra Leone’s Strengthened Capital Base and Customer Confidence

UBA Sierra Leone’s balance sheet grew by 27.8% in 2024, reaching NLe 5.2 billion. The growth was anchored by a 22.7% increase in customer deposits, which rose from NLe 2.8 billion to NLe 3.5 billion.

The bank also reported a strong capital position, with share capital standing at NLe 139 million which is well above the Bank of Sierra Leone’s regulatory minimum. This solid footing places UBA Sierra Leone ahead of the Central Bank’s upcoming 2025 capital requirements, reinforcing its stability and preparedness for long-term expansion.

In alignment with the national financial inclusion strategy, the bank made major strides in expanding access to banking services. Over 250,000 new accounts were opened in 2024, along with the issuance of approximately 35,740 ATM and debit cards.

Central to its growth is the bank’s “Customer-First” philosophy, which prioritizes user-friendly, accessible, and efficient service delivery. The bank has also strengthened its digital leadership through mobile banking solutions and artificial intelligence-driven platforms like LEO, enabling seamless 24/7 banking across the country.

“Our 2024 results reflect the dedication of our team and the trust of our customers. We are proud to deliver strong financial performance while advancing our mission to make banking accessible to all Sierra Leoneans,” said Mohamed Alhajie Samoura, Managing Director/CEO of UBA Sierra Leone.

Mohamed Alhajie Samoura, MD/CEO, UBA Sierra Leone

Looking ahead, the bank plans to deepen its presence by expanding its physical branch network. Among its upcoming projects is the opening of the new branch in Kono, aimed at bringing banking services closer to underserved communities.

This move signals the bank’s continued commitment to nationwide financial inclusion and positions it to capture even more market share in 2025 and beyond.

Mohamed Alhajie Samoura’s Leadership and Recognition

With nearly two decades in Sierra Leone’s banking industry, Samoura has earned widespread recognition. He is the first Sierra Leonean Managing Director of UBA Sierra Leone.

Under his leadership, UBA SL has received multiple prestigious awards. In 2023, The Banker, a Financial Times UK publication, named UBA SL Bank of the Year. The African Branding Agency recognised it among the Top 10 Institutions in Sierra Leone, while Samoura ranked among the Top 5 Financial Leaders.

UBA SL also won Climate Positive Bank of the Year at the 7th Environmental Care Awards, organized by Shout Climate Change Africa in partnership with the Sierra Leonean Metrological Agency and Freetown City Council. The African Ovation Awards honoured the bank of outstanding customer service and contributions to Sierra Leone’s social and economic development. Additionally, ten UBA Sierra Leone executives received the 2023 Sierra Leone Leadership Award, ranking among the Top 100 Emerging Leaders in the country.

UBA Sierra Leone Has Accessible, Modern Banking for All

With a nationwide network of branches and strong digital infrastructure, UBA Sierra Leone continues to make banking more accessible, inclusive, and future-forward.

The bank’s headquarters is located in Freetown, with multiple branch locations across the country providing walk-in access for customers interested in opening accounts or exploring its other services.

In addition to physical banking, UBA has solidified its leadership in digital banking through innovative platforms like its mobile banking app, debit cards, and AI-powered virtual assistant, LEO. These tools enable customers to manage their finances, make transactions, and access support anytime, anywhere.

To learn more or begin banking with UBA Sierra Leone, individuals can visit any UBA branch or go online at www.ubasierraleone.com.